advantages and disadvantages of gst in malaysia

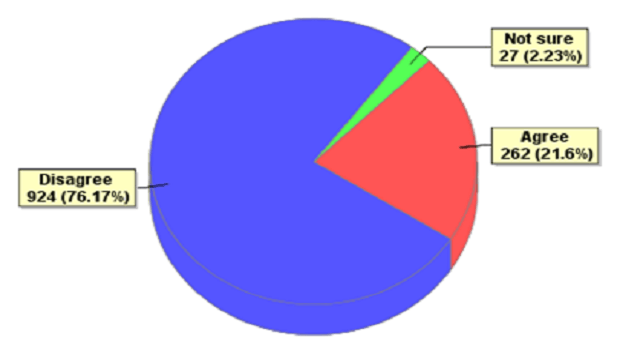

GST has drawn quite a bit of flak over the years and public opinion is generally that GST has caused prices of goods and services in Malaysia to go up without the country seeing significant benefits to the additional tax revenue collected. Consumption tax is the consumption of goods and services received at each stage of the supply chain.

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

The Advantages Disadvantages of GST in Malaysia.

. The taxation system is quite fair for consumers. All the goods and services offered in the country would be charged at 6 tax. 20 Consequences of GST.

Over the next few years it is projected to grow by at least 80 per cent. This is one of the Cons Of GST. GST is introduced in Malaysia to replace the current consumption tax which is the Sales Tax and Service Tax because it has many weaknesses.

This way can surely to help customers identify the goods with 6 percent GST in supermarkets and know who is a GST register person in Malaysia. Disadvantages of Sales and Services Tax. The Pros and Cons.

GST ADVANTAGES CONTD 39 BENEFITS OF GST CONTD 3 Less Bureaucracy GST registered company will manage their own accounting for tax. Advantages And Disadvantages Of Gst In Malaysia. GST leads to a positive effect on Indias GDP.

The Goods and Services Tax GST has been in effect for a while now in Malaysia. Officially GST is a consumption tax that is imposed on goods and services at every stage of the supply chain which typically begins at the manufacturing stage and ends at the retail stage. What your opinion when GST were implementing in Malaysia.

Sales and service tax which was 5 - 15 was reduced to 6 by GST implementation in Malaysia. Government revenue might reduce as factories and importers declare low volumes of goods in order to pay low taxes. Here is an example of how GST with a rate of 10 can be imposed on a.

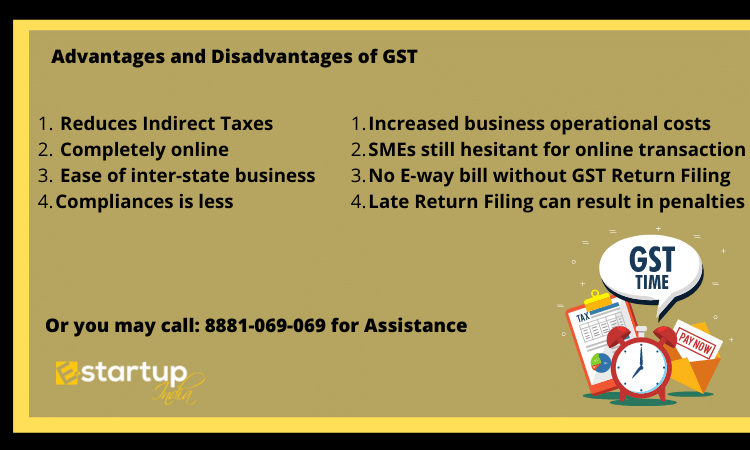

1 Easy and simple method of registration. Advantages and Disadvantages of GST in Malaysia. Thus reduce government revenue.

Furthermore the disadvantages of GST on consumer compare with sales tax is GST will mean an increase in operational costs In fact all the business will now have to employ tax professions to be GST. The GST is basically a form of taxation system imposed by the government where there is a single tax in the economy that is placed upon goods and services offered. Tax burden will not increase when income level increased.

Consequently the Malaysian government. The earlier taxation structure ie. Powered by LiveChat.

GST ADVANTAGES CONTD 37 BENEFITS OF GST CONTD Transfer pricing Manufacturing goods Under declaring 1 Eliminating hidden Imported goods activity 2 Greater Transparency GST will be shown on the invoice Consumers will know exactly whether the goods they consume are subject to tax and the amount they pay for. Rise In Complexity For Many Businesses - GST has given rise to complexity for many business owners across the nation. Compared to any other tax registration process GST registration in Malaysia can be done with ease.

Like any other reform in the country even GST has had its pros and cons in Malaysia. GST malaysia Disadvantages government business consumers The main issues concerning about the implementation of GST is the costs of the goods will increase which will burden the people in the country. 10 WHAT IS GST.

Let us see what benefits and drawbacks GST brought to the economy. Goods and Services Tax registration has been made online making it easier for people to enrol for the very first time in Malaysia. 75 lakhs could avail of the composition scheme pay a mere 1.

Easy and Simple Registration Process. Consumers pay 10 at factory price only not like GST multi stage tax the end consumers surely pay more than 6 of taxes at multi stage. 10 WHAT IS GST.

ADVANTAGE OF GST Gst will remove the cascading effect of tax on tax and as a result the price will be low because of the lower tax component in it lowering of the price will increase demand resulting in higher growth and employment level lower tax rate will increase the tax compliance and hence the revenue of the government lower prices of the commodity would also mean a. The collection of the GST can increase the revenue from the tourism industry as some revenue is extracting directly from tourists where the tourists spend on goods and services that made in Malaysia and overall government revenue will be increased. GST has advantages to certain degree because the revenue increased is not just from local people but from the foreigners too.

This new tax regime has caused some businesses uncertainty as well as money. What are the advantage and disadvantage that we can see are. First the GST will provide nearly twice as much tax income as the SST.

In some jurisdictions it is also known as Value Added Tax VAT. 5282018 Advantages and Disadvantages of GST in Malaysia Business Setup Worldwide 27GST one of the most. The idea of introducing GST in Malaysia was first conceived in 2005 for.

ADVANTAGES OF GST Goods and service tax GST is a good tax system that has been applied in Malaysia and some country. GST is based on the valued-added concept to avoid duplication in tax collected. This paper examines the impact of goods and services tax GST on the Malaysian economy in two perspectives which are sectoral responses.

Therefore the end consumer only pays 6 at the multi-tax stage. 21 Expected Aggregate Consumption and. Factories or importer can under declare the volume and value of the goods to pay minimum taxes.

SST causes cascading and compounding effect. SSTs criticism and disadvantages are as follows-While most countries are moving to GST Malaysia reverted back to SST even though many believe it to be a less progressive form of tax. - GST registration in Malaysia can be performed with ease relative to any other method of tax registration.

GST lowers transportation costs by reducing border taxes and by addressing inconsistencies in the check-post. Goods and Services Tax GST Advantages and Disadvantages. A 20 decline in the cost of logistics for non-bulk commodities is simply an expected result.

For businesses GST claim back on tax has been difficult can be declined and requires a minimum of RM500000 in annual sales. It is more fair taxation system impose on end consumers. GST is introduced in Malaysia to replace the current consumption tax which is the Sales Tax and Service Tax because it has many weaknesses.

Good and Services Tax or known as GST is a multi-stage broad-based consumption tax on good and services based on the value added concept. 112 Types and rates of GST. GST is also one of the overall tax reform parts at where it make the taxation system to be more effective efficient transparent business friendly and it will also be capable in generating more stable source of revenue to the country.

Everyone will pay tax and tax burden is spread over instead of just relying on income taxes derived from 15 of the working population. There are some advantage and give the good effect to the society and country. It is more efficient than the other tax which sales and service tax SST.

Advantages And Disadvantages Of Gst In Malaysia. SMEs with a total income of Rs. Advantages and Disadvantages of GST in Malaysia.

Compared to the GST tax system SST is way. Consumers only pay a 10 factory price unlike the GST multi-stage tax. Although the government claim that the implementation of GST will not hurt the businesses and people as the tax paid on the inputs at the previous stage is claimable or.

111 Basic Concept of GST. The GST applies to more businesses than the SST. The purpose of the GST is mean to create a single overall taxation.

The Advantages Disadvantages Of Gst In Malaysia

Gst Vs Sst In Malaysia Mypf My

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Comparing Sst Vs Gst What S The Difference Comparehero

Advantages And Disadvantages Of Gst In Malaysia Business Setup Worldwide

Advantages And Disadvantages Of Sst Malaysia 2019 Business Setup Worldwide

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Advantages Of Gst 3 Advantages And Disadvantages Of Tax 3 Advantages Of Gst In Malaysia In The Studocu

Gst Vs Sst Which Is Better Rightways

Do You Agree That Gst Should Be Implemented In Malaysia Tax Updates Budget Business News

Know About Advantages And Disadvantages Of Gst E Startupindia

Disadvantages Sst Reduce Government Revenue This Is Because Factories Or Course Hero

The Advantages And Disadvantages Of Taxation In Malaysia Rsupsoeradji Id Custom Academic Help

Advantages And Disadvantages Of Gst In Malaysia Business Setup Worldwide

Advantages And Disadvantages Of Gst In Malaysia Turnerdsx

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Advantages Of Gst 3 Advantages And Disadvantages Of Tax 3 Advantages Of Gst In Malaysia In The Studocu

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Advantages Disadvantages Of Gst General Sales Tax In Belize Business Setup Worldwide